Portugal: A Glimpse into Europe's Future in an Era of Austerity and HTA Reform?

By Xcenda

HTA QUARTERLY | WINTER 2017

Portugal: A glimpse into Europe’s future in an era of austerity and HTA reform?

By Chelsey Campbell, PharmD, MBA, MS and Ryan Clark, PharmD, MBA, MS

Structure of Portuguese healthcare system

Reform of HTA in wake of global pressures

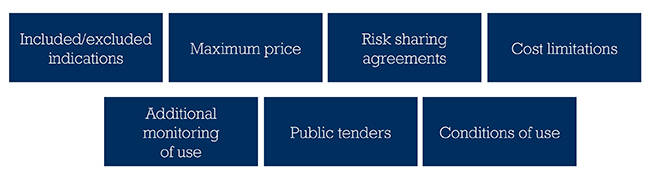

Now responsible for medical devices in addition to pharmaceuticals, the independent Health Technology Assessment Committee (Comissão de Avaliação de Tecnologias de Saúde; CATS) performs a regulatory, relative effectiveness, and cost-effectiveness assessment of novel products.1 SiNATS also emphasizes more creative solutions to controlling cost via access management, such as conditional reimbursement via managed entry agreements, ongoing registries, and reassessments. To incorporate these aspects, a pricing evaluation also takes place, and the following aspects are negotiated by the national agency as part of the approval process:

Risk-sharing schemes are also more critical under SiNATS. Both performance-based (ie, based on clinical factors) and cost-based (ie, based on financial factors) risk-sharing schemes will be employed.1 SiNATS aims to combine both financial and performance schemes to address key areas of concern:

After agreement has been reached with the Ministry of Health, technology reports will be published outlining general recommendations for use and instructions on how the product should be used. Work for the manufacturer is not done yet, however: ongoing technology reassessment based on real-world evidence generation causes market access in Portugal to be an ongoing process.

Products approved before the introduction of SiNATS are not exempt either, as the reform calls for a reassessment of existing technologies.2 Disease states like cancer and HIV will be targeted using information from manufacturers along with outcomes data from national registries. INFARMED utilizing as much of the data available, both clinical and economic, is another focus of SiNATS.1 Using international registries/data monitoring sources like EUnetHTA and national HTAs and the national system (including academic centers and an HTA-sponsored database linked to hospital data), INFARMED will be poised to make well-informed decisions on prices and reimbursement of novel products. The key targets for the patient registries include:

- Oncology

- HIV/AIDS

- Orphan/rare disease products

- Medical devices

- Hepatitis C

Key Take-aways

Although Portugal may not be one of the top targets for European market access due to its smaller size, the recent reforms in the country appear to be a signal of the way Europe may be shifting to better control the cost of healthcare. SiNATS focuses on global integration, big data, risk sharing/managed entry agreements, cost-effectiveness research, comparative effectiveness, and real-world evidence generation—all of which are hot button topics across the globe. To secure access in Portugal, it is critical that manufacturers consider early- and late-phase health economic and outcomes research along with novel contractual agreements to enhance product value and associated reimbursement. While Portugal may not initially be a high priority at product launch, it may be a sign of things to come when seeking European market access.

The article should be referenced as follows:

Campblell C, Clark R. Portugal: A glimpse into Europe’s future in an era of austerity and HTA reform? HTA Quarterly. Winter 2017. Jan. 19, 2017.

References

- New HTA and prices & reimbursement system (SiNATS) in Portugal:

impact on the reimbursement of oncologic medicines. IHF Chicago: 39th World Hospital Congress. 2015. http://www.apdh.pt/sites/apdh.pt/files/2015IHFChicago_JOAO MARTINS (2).pdf. - The Economist. Value-based healthcare in Portugal. https://www.eiuperspectives.economist.com/sites/default/files/ValuebasedhealthcarePortugal_0.pdf.

- Tavares AI. Portuguese health system, an overview and a SWOT review. Open Public Health J. 2016;9:16-30. http://benthamopen.com/FULLTEXT/TOPHJ-9-16.

- OECD.org 2016. https://data.oecd.org/healthres/health-spending.htm#indicator-chart.

- Barra M. Portuguese government changes reference countries for 2015 drug prices – Slovenia, Spain and France as new reference countries. https://pharmupdates.wordpress.com/2014/11/19/portuguese-government-changes-reference-countries-for-2015-drug-prices-slovenia-spain-and-france-as-new-reference-countries/.

- SNS. SiNATS - Sistema Nacional de Avaliação de Tecnologias de Saúde. http://www.infarmed.pt/portal/page/portal/INFARMED/MEDICAMENTOS_USO_HUMANO/SINATS.