FINOSE Finishes 2 Joint HTAs in the Nordics

By Xcenda

HTA Quarterly | Fall 2019

Market Trends and Updates: FINOSE Finishes 2 Joint HTAs in the Nordics

Joint Assessments in Europe

Since 2016, 4 joint assessment agencies have been created across Europe: BeNeLuxAIr (Belgium, Netherlands, Luxembourg, Austria, and Ireland), La Valetta (Italy, Spain, Greece, Portugal, Slovenia, Cyprus, Malta, and Croatia with France as an observer), Visegrad (Czech, Hungary, Poland, Slovakia, Croatia, and Lithuania), and most recently, FINOSE (Finland, Norway, and Sweden). The establishment of these groups is in alignment with a 2004 priority area declared by the European Commission and Council of Ministers. This declaration for the formation of a joint health technology assessment (HTA) established the EUnetHTA project in 2006, which aims to formalize a permanent cooperation after 2020. The participation of the majority of European countries already in such collaborations is a promising first step toward this strategic goal.

FINOSE Collaboration

In 2017, a Memorandum of Understanding (MoU) was signed by the Directors General of the HTA agencies of Finland (Finish Medicines Agency [Fimea]), Norway (Norwegian Medicines Agency [NoMA]), and Sweden (Dental and Pharmaceutical Benefits Agency [TLV]). This MoU established the collaboration network, FINOSE, in which the 3 HTA agencies write joint assessment reports that agree on clinical data to inform modeling, quality-adjusted life-year (QALY) gain, and relative efficacy. The collaboration is not intended for joint access and reimbursement decision making but to facilitate the application process and support earlier access to medical technologies across the Nordic area through a novel evaluation process. FINOSE officially launched in 2018 and plans to pilot the program until 2020.

Table 1. FINOSE and Collaborators’ Missions

Assessment by FINOSE seeks to synergize communication between agencies rather than adding additional processes. Only 2 new steps are required by manufacturers for submission: simultaneous submission to each Fimea, NoMA, and TLV and signing of a confidentiality waiver to allow communication between the agencies. Since evaluation by FINOSE requires manufacturers to consent to data sharing among all involved HTAs, topic selection is initiated by the manufacturer instead of FINOSE. The overall assessment process for application and evaluation is summarized in Figure 1.

Figure 1. FINOSE Assessment Process Summary

Completed FINOSE Assessments

The type of assessment completed by FINOSE can vary depending on discussions at the scoping meeting and the availability of robust data in the submission package. To date, 2 pilot FINOSE assessments have been completed, both in high severity oncology disease states. Each of these assessments were initiated by the respective manufacturer in January 2019 and released in June 2019. An indication evaluation for Xtandi (enzalutamide) took place within the framework of a grant application, and a health economic evaluation for Tecentriq (atezolizumab) was completed after submission by Roche. TLV and NoMA were authors of the reports and Fimea had a reviewer role.

Xtandi

Xtandi is an androgen receptor-signaling inhibitor evaluated by FINOSE for a new indication in the treatment of adult men with high-risk nonmetastatic castration-resistant prostate cancer (nmCRPC). The pivotal, global, phase 3 placebo-controlled trial’s primary endpoint was metastasis-free survival (MFS) and the secondary endpoint was overall survival (OS). No standard of care for nmCRPC exists due to the heterogeneous progression seen among patients. Though the clinical guidelines for treatment vary between collaborating countries (Table 2), FINOSE agreed with the manufacturer conclusion of continuous androgen deprivation therapy (ADT) as a comparator.

Table 2. Summary of nmCRPC Treatment Guidelines in FINOSE Collaborating Countries

FINOSE’s efficacy evaluation pointed out several shortcomings of the trial design for being able to inform a single technology assessment, including unrealistic features of the trial design, such as detecting metastases by bone scans and computed tomography (CT) rather than the expert, guideline-recommended magnetic resonance imaging (MRI) and positron emission tomography (PET) scans. Further, post-progression treatment given in the trial was not reflective of practice in Sweden or Norway.

In terms of clinical efficacy, FINOSE found uncertainty in the MFS modeling and that the OS modeling by the manufacturer was inappropriate. Without these data, a claim for long-term survival was not supported, and a primary contributing factor to QALY gain was lost. This uncertainty was compounded by the heterogeneous nature of the disease progression and the variance in price across the participating countries.

Following the release of the joint assessment, only TLV announced a national decision to not extend existing subsidization of Xtandi to include this new indication. TLV did not find the increased cost of treatment with Xtandi in nmCRPC to be justifiable due to the lack of demonstrable increases in survival. This decision was in alignment with an appraisal from the National Institute for Health and Care Excellence (NICE), which did not recommend Xtandi due to uncertainty in cost-effectiveness and any survival benefits. The cost-effectiveness of Xtandi was also questioned when evaluated by the pan-Canadian Oncology Drug Review Expert Committee. In Canada, the drug will only receive reimbursement if its cost-effectiveness and budget impact are improved.

Tecentriq

Tecentriq (atezolizumab) is an anti-PD-L1 monoclonal antibody for use in combination with bevacizumab, carboplatin, and paclitaxel (ABCP) for nonsmall cell lung cancer (NSCLC). The FINOSE report focused specifically on NSCLC patients with activating EGF receptor or ALK fusions and/or patients with liver metastases.

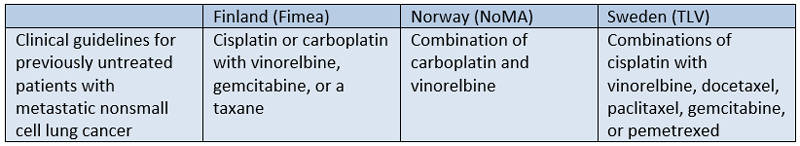

Table 3. Summary of NSCLC Treatment Guidelines in FINOSE Collaborating Countries

Clinical guidelines in Norway, Sweden, and Finland largely agree on NSCLC treatment paths (Table 3). Previously untreated patients are recommended platinum-based chemotherapy. Subgroups with high PD-L1 expression should receive pembrolizumab, and those with EGFR or ALK translocations should receive targeted tyrosine kinase inhibitors (TKIs) prior to starting platinum-based chemotherapy. FINOSE therefore found the manufacturer’s comparator of carboplatin with vinorelbine or pemetrexed, or cisplatin with pemetrexed, to be relevant.

The pivotal, open-label, 3-arm trial for Xtandi evaluated the add-on effect of Tecentriq to backbone BCP (bevacizumab plus carboplatin plus paclitaxel) chemotherapy. The EGFR/ALK-positive subgroup was not originally stratified for efficacy evaluation in the trial, though a second-line indication for ABCP treatment in this population was granted by the European Commission.

FINOSE found a clinically meaningful benefit for Tecentriq as an add-on to treatment after failure with TKI therapy despite a small study population (n=104). These features increased uncertainty in the analysis and were further compounded by an indeterminate treatment duration effect that can cause variance in the sensitivity analyses. Ultimately, analysis by FINOSE found the QALYs gained was between 0.4 and 1 for this population. FINOSE did not conduct cost-effectiveness evaluations for the liver metastases subgroup due to uncertain and unreliable efficacy.

To date, none of the participating HTAs have announced a national reimbursement decision based on the results of this joint assessment. Outside of the FINOSE collaboration, NICE made a recommendation for Tecentriq as part of combination ABCP therapy for patients previously untreated for NSCLC or in certain cases after targeted EGFR/ALK+ therapy has failed. FINOSE’s concern regarding treatment duration is mirrored in the NICE decision, with NICE adding the caveat that Tecentriq is only recommended if stopped before 2 years of consistent treatment.

Considerations for Manufacturers

Crossing borders with joint HTA submissions comes with new opportunities, but also new challenges, for manufacturers to consider.

- Reducing workloads for both manufacturers and reviewers through simultaneous submission can shorten time to market

- Reducing the effort to apply for subsidies can mean that companies go to all 3 countries and do not choose to concentrate their efforts on only 1 or 2 countries, increasing access to therapy

- Aligning assessment methodologies can reduce submission complexity to several countries in the short term and stimulate the use of real-world evidence in the long term

- Enabling review of a larger patient population across collaborating countries can spur data for innovative pricing models

- Diverging clinical guidelines and standards of care between collaborators can complicate decisions for a single comparator

- Emerging differences in drug pricing and healthcare costs that inform economic models can make interpretation difficult

Summary

With 2 decisions in high-severity, high-impact oncology areas, FINOSE offers a novel pathway for potentially expedited access to therapies in Nordic countries. The impact of limitations due to differences in standard of care treatment and drug pricing across the collaborators remains unclear, with only 1 national decision released thus far and 5 still pending.

The article should be referenced as follows:

Danavar A, Tormey K, Gittings K, Persson U, Migliaccio-Walle K. FINOSE finishes 2 joint HTA assessments in the Nordics. HTA Quarterly. Fall 2019. https://www.xcenda.com/insights/htaq-fall-2019-finose-finishes-2-joint-hta-assessments-nordics.

Sources

- Fimea. Development and HTA. 2018.

- Fimea. Memorandum of Understanding. September 22, 2017.

- FINOSE. FINOSE joint assessment report: Tecentriq (atezolizumab). June 27, 2019.

- FINOSE. FINOSE joint assessment report: Xtandi (enzalutamide). June 11, 2019.

- FINOSE. Process for Joint Assessment. June 18, 2018.

- FINOSE. Summary from FINOSE strategic HTA and industry meeting. March 27, 2018.

- Norwegian Medicines Agency. Our goals and tasks. January 19, 2018.

- TLV. The first pilots for evaluation in the Nordic collaboration FINOSE are in progress. January 24, 2019.

- TLV. Welcome to the TLV.

- TLV. Xtandi’s current subsidy does not extend to high-risk non-metastatic castration resistant prostate cancer. June 18, 2019.