The biosimilars marketplace: Part one

By Xcenda

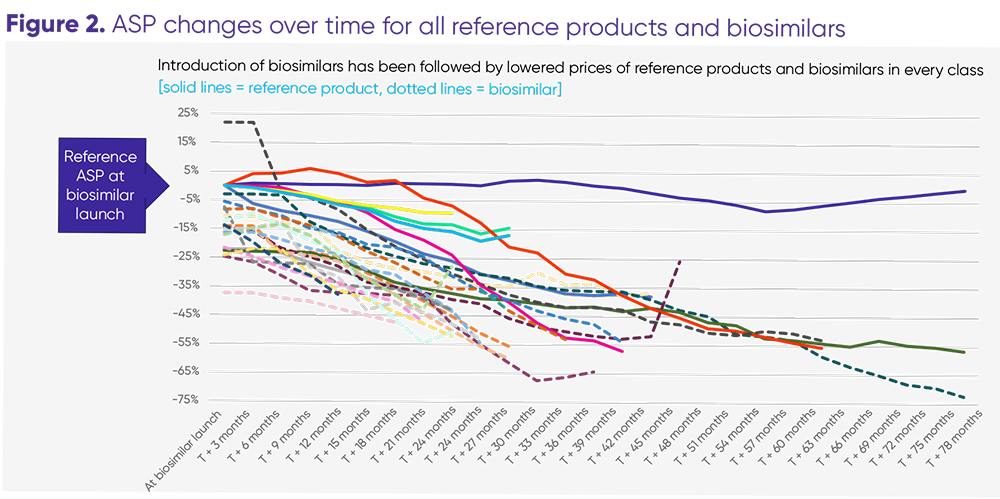

As of June 2022, 22 biosimilars have been launched against 7 reference products in the US. These biosimilars are currently available in 3 therapeutic categories: oncology, supportive care, and immunology. The introduction of competition into the biologics market has led to dramatically lower prices not only for biosimilars, but also for reference products.

Xcenda analysis shows that shows how biosimilars lead to significant cost savings to patients and the healthcare system. We found that the average sales price (ASP) for the biosimilars for 4 of the reference products were 38% - 64% less expensive than the reference products so patients using those products benefit from lower costs. On the flip side, we found that for 3 of the reference products are less expensive than the biosimilars as they fight to maintain market share. Biosimilars drive down costs for the class in 2 ways: Either by offering a treatment alternative at a substantial discount to the reference biologic, or by forcing the manufacturer of the reference biologic to reduce the price to match (or be lower than) the biosimilar.

The data show biosimilars are succeeding in what they were designed to do: lower prescription drugs costs to patients and drive savings in the system. With more biosimilars in development, their adoption and associated savings should accelerate—provided the market is permitted to operate as it is currently designed.

.jpg?h=320&iar=0&w=540&useCustomFunctions=1¢erCrop=1&hash=D3212DEB9EF225EFD30381936A4BEC29)